Pharmacovigilance Outsourcing Market Size Worth USD 12.12 Billion by 2034 Driven by Rising Clinical Trials and Stringent Regulations

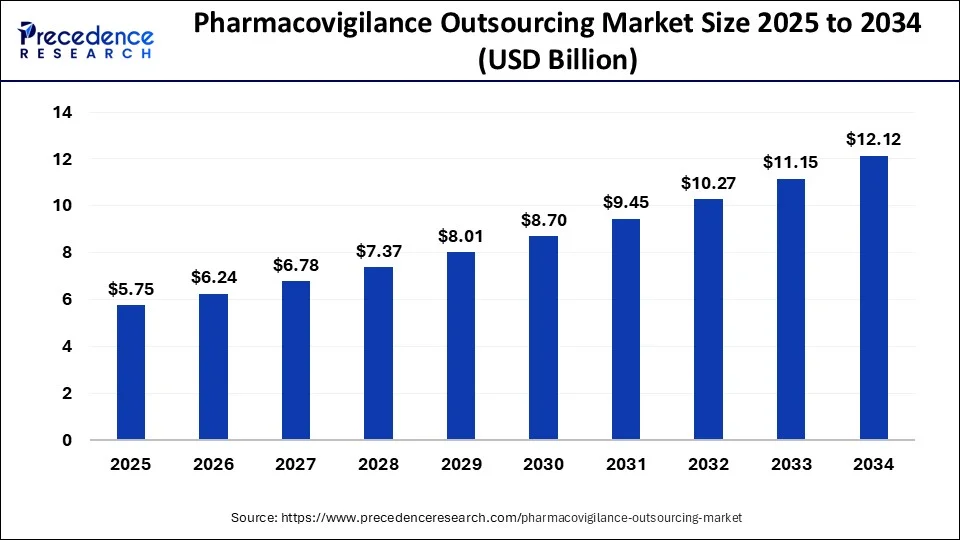

According to Precedence Research, the global pharmacovigilance outsourcing market size will grow from USD 5.75 billion in 2025 to nearly USD 12.12 billion by 2034, expanding at a solid CAGR of 8.64%. Rising clinical trials, stricter regulations, and demand for AI-driven safety solutions are fueling the shift toward specialized outsourcing partners.

Ottawa, Sept. 24, 2025 (GLOBE NEWSWIRE) -- The global pharmacovigilance outsourcing market size is expected to be worth over USD 12.12 billion by 2034, increasing from USD 5.75 billion in 2025. The industry is growing at a CAGR of 8.64 % from 2025 to 2034. The market is driven by the rising number of clinical trials and stringent regulatory requirements.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4449

✚ Pharmacovigilance Outsourcing Market Valuation and Projections:

2024 (Historic):

- The pharmacovigilance outsourcing market size was valued at approximately USD 5,290 million.

2025 (Current):

- The market is calculated at nearly USD 5,750 million in 2025.

2034 (Forecast):

- The market is estimated to reach about USD 12,120 million by 2034.

CAGR (2025-2034):

- A Compound Annual Growth Rate (CAGR) of roughly 8.64% is expected for the forecast period from 2025 to 2034.

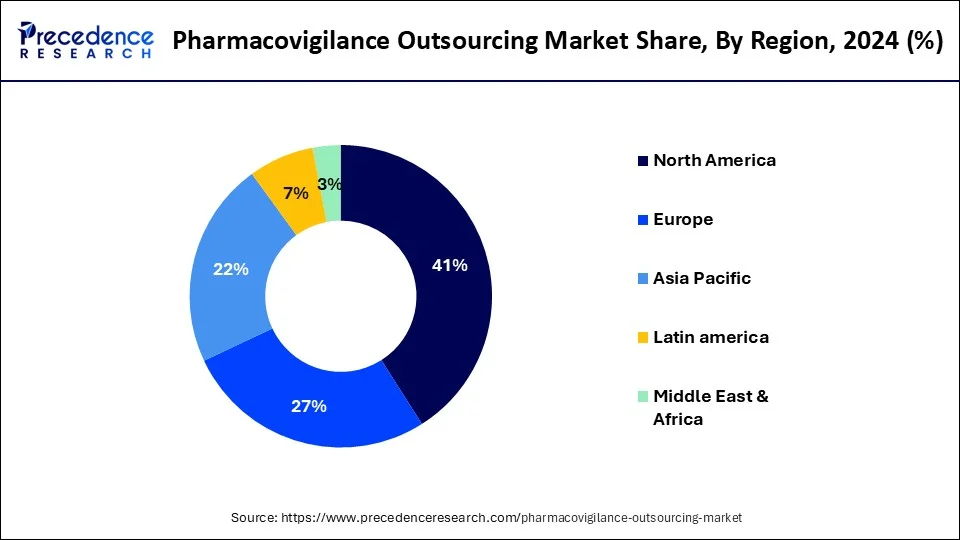

✚ Regional Trends:

Dominant Regions

- North America dominated the pharmacovigilance outsourcing market with the major market share of 41% 2024, due to its large pharmaceutical market and advanced infrastructure.

Fastest-Growing Region

- The Asia Pacific region is expected to grow at the highest CAGR during the forecast period, driven by growing clinical trials in emerging economies and increasing regulatory focus on drug safety.

✚ Key Market Segments:

By Service:

- Pre-marketing pharmacovigilance services dominated the market in 2024.

- Post-marketing pharmacovigilance services are expected to record the fastest CAGR during the forecast period.

By Service Provider:

- Contract Research Organizations (CROs) held the largest market share in 2024.

- Business Process Outsourcing (BPO) providers are projected to grow at the fastest CAGR.

What is Pharmacovigilance Outsourcing?

The pharmacovigilance outsourcing market is significant because it permits pharmaceutical companies to improve regulatory compliance and even patient safety, focus on core business operations such as R&D, and gain access to specialized expertise and technology.

Firms can concentrate their internal resources on drug discovery, development, and commercialization by transferring customized pharmacovigilance tasks to third-party providers. The raised focus on real-world data collection and even patient-centric care thus strengthens the need for comprehensive safety evaluations via outsourcing.

Major Government Initiatives for Pharmacovigilance Outsourcing

- National Pharmacovigilance Week in India - The Indian government (via DCGI / Indian Pharmacopoeia Commission) is running an annual campaign (“National Pharmacovigilance Week”) to promote ADR (Adverse Drug Reaction) reporting through simplified digital platforms and public awareness. This increases demand for outsourced digital‐reporting tools and case management services across private and public sectors.

- AYUSH Ministry’s ‘Trinetra’ Portal for Pharmacovigilance in Indian Systems of Medicine - The Indian AYUSH ministry is launching a new national portal called ‘Trinetra’ aimed at pharmacovigilance in traditional/modern Indian systems of medicine and for preventing misleading advertisements. Such a portal would create outsourced opportunities for technology, monitoring, content moderation, and regulatory compliance support.

- Revised Pharmacovigilance Guidelines for Marketing Authorization Holders (MAHs) in India (Version 2.0) - The Indian Pharmacopoeia Commission (IPC) has released updated guidance for MAHs (effective February 2025). These stricter and more detailed requirements increase the need for specialized outsourced pharmacovigilance services to help MAHs comply, especially for ADR reporting, risk management, and safety communication.

- WHO’s Push for Improved Electronic Reporting & Tools in Low- and Middle-Income Countries - WHO has been facilitating training (for example, Uganda) on tools like VigiFlow, VigiMobile, etc., to strengthen electronic reporting of vaccine/medicine safety events. Such initiatives often require outsourcing partners for development, maintenance, customization of these tools, and supporting data flow and regulatory reporting capacities.

-

Regulatory Harmonization & Model Tools for Risk Management Plans (RMPs) - Through workshops (for example, organised by WHO and partners for various African national regulatory authorities), model tools and guidelines for assessing Risk Management Plans are being piloted and refined. These require skills and services that are often outsourced, such as gap assessment, preparing RMPs, signal detection, and regulatory drafting.

Pharmacovigilance Outsourcing Market Trends

- Increased Adoption of Automation and Artificial Intelligence: Outsourcing partners are increasingly using artificial intelligence (AI) and machine learning to automate case processing, expedite signal detection, and improve the accuracy and consistency of adverse event reporting.

- Rising Demand for Real-World Evidence (RWE): Pharmaceutical companies are leveraging real-world data, such as electronic health records and patient registriesthrough outsourced providers to enhance post-market surveillance and support regulatory decision-making.

- Growing Complexity of Global Regulatory Requirements: As regulations evolve and become more stringent across different regions, companies are outsourcing pharmacovigilance to ensure continuous compliance and access to specialized global regulatory expertise.

- Expansion into Emerging Markets: There is a clear shift toward outsourcing pharmacovigilance operations to countries in Asia-Pacific, Latin America, and Eastern Europe due to cost advantages, skilled workforce, and increasing regional clinical trial activity.

-

Shift Toward End-to-End Safety Service Models: Pharmaceutical and biotech companies are increasingly opting for full-service pharmacovigilance outsourcing, where a single vendor handles everything from case intake and processing to risk management and regulatory submissions.

Pharmacovigilance Outsourcing Market Opportunity

Why is accessing Specialized Skills for Navigating Regulatory Landscapes an Opportunity for the Market?

Accessing specialized regulatory skills is a prime opportunity for the pharmacovigilance (PV) outsourcing market because pharmaceutical firms face an increasingly complex regulatory landscape with evolving laws worldwide, requiring specialized expertise to guarantee compliance, mitigate risks, and avoid costly delays or penalties.

Pharmaceutical companies usually lack the in-house resources or the deep, current knowledge to manage the ever-changing regulatory environment. Outsourcing offers access to skilled professionals with in-depth knowledge of worldwide safety regulations.

➤ Get the Full Report @ https://www.precedenceresearch.com/pharmacovigilance-outsourcing-market

Pharmacovigilance Outsourcing Market Challenge

Why is Navigating Communication and Language Barriers a Challenge for the Market?

Navigating communication and language barriers is challenging for pharmacovigilance outsourcing due to the potential for misinterpretations of vital medical information, which can contribute to underreporting of adverse events, hamper regulatory compliance, and complicate staff training.

Language barriers complicate the training as well as onboarding of new pharmacovigilance professionals in outsourced settings, demanding more effort and resources to achieve competency. Effective communication is vital for navigating and adhering to varying regulatory requirements across various countries, which can be challenging with diverse linguistic capabilities.

Pharmacovigilance Outsourcing Market Report Coverage

| Report Attributes | Key Statistics |

| Market Size in 2024 | USD 5.29 Billion |

| Market Size in 2025 | USD 5.75 Billion |

| Market Size in 2031 | USD 9.45 Billion |

| Market Size by 2034 | USD 12.12 Billion |

| Growth Rate 2025 to 2034 | CAGR of 8.64% |

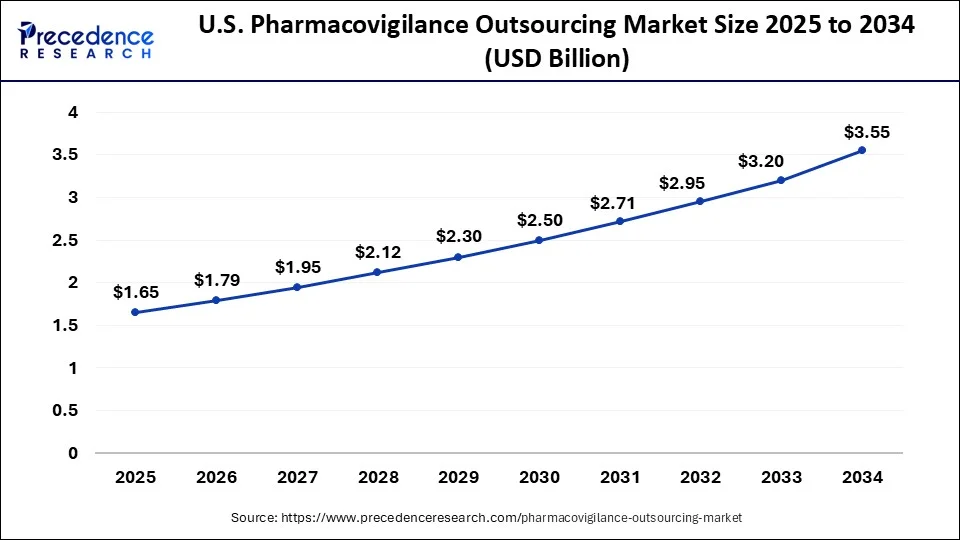

| U.S. Market Size in 2025 | USD 1.65 Billion |

| U.S. Market Size by 2034 | USD 3.55 Billion |

| Leading Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Service Providers, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

| Key Players | Labcorp Drug Development, Icon Plc, Cognizant Technology Solutions Corporation, Ergomed Plc., Capgemini, Genpact Limited, Accenture Plc., Iqvia Holdings Inc., International Business Machines Corporation, Bioclinica Inc., and others |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

How the Pharmacovigilance Market Drives Pharmacovigilance Outsourcing

Size and Momentum:

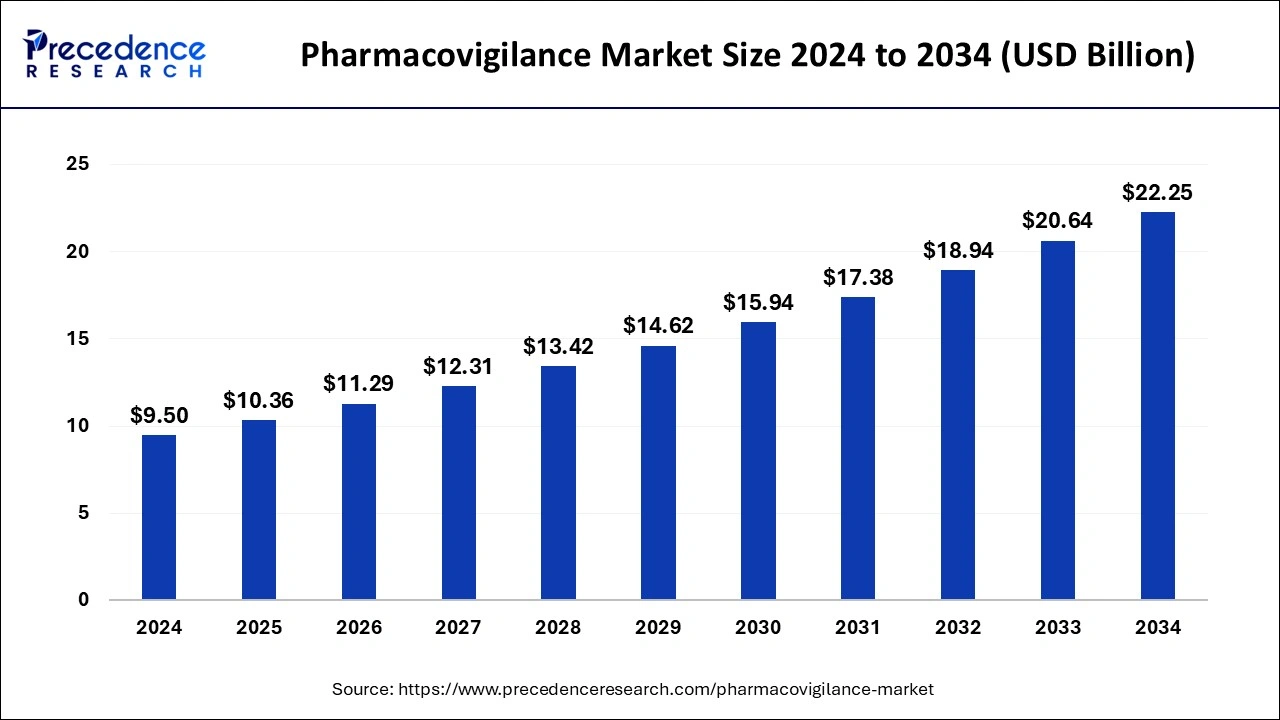

The global pharmacovigilance (PV) market grows from USD 10.36 billion (2025) to nearly USD 22.25 billion by 2034 with a solid CAGR 8.88%, underpinned by rising ADR incidence, stricter regulation, and expanding post-marketing surveillance. Contract outsourcing is identified as the highest-revenue service-provider segment, and Phase IV holds the largest share—both features that structurally channel spend toward external vendors.

In parallel, the pharmacovigilance outsourcing market scales from USD 5.29 billion (2024) to ~USD 12.12 billion by 2034 (CAGR 8.64%), with North America at 41% share (2024) and Asia Pacific the fastest-growing delivery/consumption base.

Demand Transmission: From PV Market to Outsourcing

Volume Pressure: More products, label expansions, and Phase IV surveillance inflate ICSR, literature, and PSUR/PBRER workloads—routinely overflowed to CRO/BPO partners for scale.

Complexity Pressure: Expanding global compliance (FDA/EMA/WHO initiatives; national programs) increases cadence and sophistication of case processing, signal detection, and benefit–risk reviews, favoring specialized external teams.

Operating-model Pressure: With contract outsourcing already the leading PV service-provider model, procurement paths, SLAs, and validated platforms are in place—shortening time-to-outsource and amplifying vendor share of work.

Regional Flywheel: PV demand anchors in North America (regulatory stringency, high trial density) while Asia Pacific provides cost-efficient capacity and rising trial volumes—an archetypal on-shore/off-shore split that accelerates outsourcing.

Pharmacovigilance Market Key Takeaway

- North America market has generated 31.14% of the total revenue share in 2024.

- Asia Pacific region is expanding at a CAGR of 10.9% between 2025 to 2034.

- By end user, the pharmaceutical companies dominate the market with the largest revenue share 42.8% in 2024.

- By service provider, the contract outsourcing segment has generated a revenue share of 60% in 2024.

- By clinical trial phase, the phase IV segment has garnered a revenue share of 76% in 2024.

- By process flow, signal detection has held a revenue share of around 39.6% in 2024.

- By therapeutic area, the oncology segment has captured a revenue share of over 26.8% in 2024 with a CAGR of 11.2%.

- By type, spontaneous reporting has accounted revenue share of 30.4% in 2024.

Pharmacovigilance Market Companies

- ICON Plc

- Pharmaceutical Product Development LLC

- Parexel International Corporation

- IQVIA

- Quanticate

- Bioclinica

- Covance Inc.

- Accenture Plc

- IBM Corporation

- Novartis

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1442

Pharmacovigilance Outsourcing Market Regional Analysis

How did North America Dominate the Pharmacovigilance Outsourcing Market?

North America dominates the market due to its established and even large pharmaceutical industry, stringent regulatory frameworks such as the FDA's REMS, high levels of drug consumption and associated adverse events, advanced healthcare infrastructure, and even early adoption of sophisticated pharmacovigilance technologies such as AI and big data analytics. The ongoing focus on novel therapies and the large number of clinical trials conducted in the region drive the demand for extensive post-marketing surveillance and also risk management.

How big U.S. Pharmacovigilance Outsourcing Market?

The U.S. pharmacovigilance outsourcing market size was exhibited at USD 1.52 billion in 2024 and is predicted to be worth around USD 3.55 billion by 2034, at a CAGR of 8.85% from 2025 to 2034

The U.S. dominates the regional market due to its position as the world’s largest pharmaceutical hub, with the highest number of drug approvals, clinical trials, and R&D investments. Stringent regulatory requirements from the FDA, including mandatory post-marketing surveillance and risk management plans, have increased the need for specialized pharmacovigilance services.

To manage growing volumes of safety data and ensure compliance, U.S.-based pharmaceutical and biotech companies increasingly outsource these functions to global CROs and tech-driven service providers. The presence of major outsourcing firms like IQVIA, Accenture, and Cognizant, along with strong data infrastructure and early adoption of AI and automation in drug safety, has further solidified the U.S.'s leadership in this space.

Why is Asia-Pacific the Fastest-growing Pharmacovigilance Outsourcing Market?

Asia-Pacific's market is growing fastest due to a combination of cost advantages, a rise in clinical trials, a large and even expanding pharmaceutical industry, supportive government policies, and advanced technological adoption for enhanced safety monitoring. There is a substantial rise in the number of clinical trials being conducted in the region, mainly in countries such as China, India, and South Korea. This growth in trials creates a greater need for efficient PV services to tailor trial-related events and ensure patient safety.

China dominates the regional market due to its rapidly expanding pharmaceutical industry, increasing clinical trial activity, and strong government support for drug safety and regulatory modernization. With the National Medical Products Administration (NMPA) aligning more closely with international pharmacovigilance standards (like ICH guidelines), pharmaceutical companies operating in China face heightened safety and compliance demands, driving the need for outsourced expertise.

Additionally, China offers a large, skilled workforce and cost-effective operations, making it an attractive hub for both domestic and multinational companies to outsource pharmacovigilance functions such as case processing, signal detection, and regulatory reporting. The growth of local CROs and technology-enabled PV providers has further reinforced China’s leadership in the region.

Why is Europe Showing Significant Growth in the Pharmacovigilance Outsourcing Market?

Europe's market is growing because of stringent and complex EU pharmacovigilance regulations that need deep expertise for compliance. The European Union has some of the globe's most comprehensive pharmacovigilance legislation, including the EU Clinical Trials Regulation and Medical Devices Regulation. Firms must navigate this intricate framework, along with meeting diverse local requirements across different member states, which is a remarkable operational burden. Outsourcing partners provide the necessary expertise to handle this complexity and guarantee adherence to evolving standards.

Germany dominates the regional market due to its strong pharmaceutical and biotechnology sectors, advanced regulatory infrastructure, and leadership in clinical research across the EU. As home to several top-tier pharma companies and contract research organizations (CROs), Germany plays a central role in post-marketing surveillance and drug safety compliance, particularly under the EU’s stringent pharmacovigilance regulations. The country’s emphasis on high-quality data standards, coupled with its access to skilled pharmacovigilance professionals and robust digital health infrastructure, makes it an attractive base for both outsourcing and insourcing PV activities.

Pharmacovigilance Outsourcing Market Segmentation Landscape:

Why Did the Pre-Marketing Pharmacovigilance Services Segment Dominate the Pharmacovigilance Outsourcing Market?

The pre-marketing pharmacovigilance segment dominates the market because it is important for gathering the safety data needed by regulatory bodies for drug approval, permitting early risk detection and also mitigation before a product launches, and permits pharma firms to handle compliance effectively while maintaining a focus on core R&D activities. Outsourcing offers access to specialized as well as experienced pharmacovigilance physicians and even scientists who are experts in rigorous drug safety processes, which may be expensive to hire and maintain in-house.

The post-marketing pharmacovigilance services segment is anticipated to register rapid growth in the pharmacovigilance outsourcing market during the forecast period. Due to the increased volume and complexity of drugs, rising patient populations, the need to meet stringent regulatory requirements, and the expanding usage of advanced technologies such as AI and cloud-based platforms for data analysis. More drugs are being developed and reaching the market, exposing them to larger, more numerous patient populations. This raises the likelihood of encountering unforeseen side effects, along with requiring robust monitoring to ensure safety.

Why Did the Contract Research Organizations (CROs) Segment Dominate the Pharmacovigilance Outsourcing Market?

Contract research organizations (CROs) dominate due to their ability to provide specialized expertise, cost efficiencies, and scalability, enabling pharmaceutical firms to navigate complex regulatory requirements, handle drug safety data more effectively, and also accelerate the market entry of new treatments. By streamlining operations and enhancing efficiency, outsourcing PV functions to contract research organizations (CROs) assists pharmaceutical companies in lowering R&D expenses and accelerating the overall drug development timeline, bringing the latest treatments to market faster.

The business processing outsourcing (BPO) segment is anticipated to register rapid growth in the market during the forecast period. Due to pharmaceutical companies' desire to reduce expenses and increase efficiency, they focus on core competencies such as research and development, along with access to specialized expertise. Pharmaceutical firms can concentrate on their core business activities, like research and development (R&D), by outsourcing non-core PV operations to specialized third-party providers. Events such as the COVID-19 pandemic have highlighted the vital need for robust pharmacovigilance, increasing the need for outsourcing safety monitoring and reporting services.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Pharmacovigilance Outsourcing Market Top Companies

- Labcorp Drug Development - Labcorp Drug Development provides comprehensive pharmacovigilance services, including case processing, signal detection, and regulatory reporting, to support global drug safety compliance.

- Icon Plc - ICON Plc delivers end-to-end pharmacovigilance solutions, leveraging advanced analytics and automation to enhance drug safety monitoring throughout the product lifecycle.

- Cognizant Technology Solutions Corporation - Cognizant offers scalable pharmacovigilance outsourcing services, integrating technology platforms and domain expertise to streamline adverse event management and regulatory submissions.

- Ergomed Plc. - Ergomed specializes in flexible and customized pharmacovigilance services, offering both full-service and standalone solutions for clinical and post-marketing safety.

- Capgemini - Capgemini provides digital pharmacovigilance solutions that combine automation, artificial intelligence, and global delivery models to improve safety case management and compliance.

-

Genpact Limited - Genpact deliver

s data-driven pharmacovigilance services, including case processing, literature monitoring, and risk management, supported by AI-powered insights. - Accenture Plc. - Accenture offers innovative pharmacovigilance services through its intelligent automation platforms and deep regulatory expertise to help clients ensure drug safety and efficiency.

- Iqvia Holdings Inc. - IQVIA offers a full suite of pharmacovigilance services, supported by real-world data and analytics, to help clients identify, evaluate, and mitigate drug-related risks.

- International Business Machines Corporation - IBM provides cognitive pharmacovigilance solutions using its Watson AI technology, enhancing signal detection, case triage, and regulatory compliance.

- Bioclinica Inc. - Bioclinica offers pharmacovigilance outsourcing services that include global case processing, signal management, and safety database hosting tailored for both large and emerging biopharma companies.

Case Study: End-to-End Pharmacovigilance Outsourcing for a Global Mid-Cap Biopharma

Mid-cap biopharma with 8 marketed products and 22 active trials across U.S., EU, China, and India. Adverse event (AE) volume rising 28% YoY; internal PV team at capacity; new India and China submissions require tighter compliance. Objective: outsource case intake → case processing → medical review → signal detection → aggregate reporting and RMP updates, while cutting cycle time and audit risk.

Starting Position (Q1–2025)

- 92,000 annual safety cases (63% spontaneous, 25% literature, 12% clinical)

- Median case closure time: 12.4 days; 16.8% missed SLA

- 97.1% on-time expedited reporting; two “Major” inspection findings

- Legacy systems, manual intake, limited automation

- Regulatory changes: India MAH PV Guidelines v2.0 and China NMPA–ICH alignment

Outsourcing Model

- CRO: Medical review, signal detection, aggregate reporting, literature surveillance, RMP authoring

- BPO: 24×7 multilingual case intake, triage, and data entry

- Technology: Validated safety platform, AI/NLP for narrative drafting, VigiFlow integration, cloud-based RWE feeds

- Delivery Hubs: India, Poland, Philippines; QPPV deputies in Germany and the U.S.

Implementation Timeline

- Months 0–1: Due diligence, data privacy, vendor SLAs

- Months 2–3: Safety database migration, pilot cutover

- Months 4–5: Global rollout, automation of narratives, literature bot deployment

- Month 6: AI models retrained, RMP templates standardized

- Months 7–9: RWE integration, advanced analytics for benefit–risk reviews

Results After 9 Months

- Case closure time reduced from 12.4 → 6.1 days (51% improvement)

- Regulatory submissions on-time rate improved from 97.1% → 99.7%

- First-pass quality increased to 99%

- Narrative drafting time cut by 67% via AI assistance

- Literature coverage expanded 3× with 42% fewer false positives

- Signal detection lead time reduced from 33 → 19 days

- Cost per case decreased by 23%; breakeven at Month 7

- FDA and MHRA inspections completed with zero “Major” findings

Key Lessons

- CRO–BPO blends ensure scalability and compliance across geographies

- Automation and AI significantly reduce manual workload while improving accuracy

- Local QPPV deputies and region-specific processes are essential for regulatory readiness

- Real-world evidence adds value only after harmonized data standards are in place

Conclusion

This case study demonstrates how end-to-end pharmacovigilance outsourcing helps mid-cap biopharma firms achieve regulatory compliance, improve efficiency, and reduce costs while maintaining global inspection readiness.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Pharmacovigilance Outsourcing Market Recent Developments

- In August 2025, IQVIA, a leading global manufacturer of clinical research services, commercial insights, and even healthcare intelligence, and Flagship Pioneering, the bioplatform innovation firm, declared a strategic collaboration to accelerate the advancement of breakthrough life sciences companies. This partnership is expected to help the Flagship ecosystem of biopharma companies accelerate innovations by providing IQVIA’s capabilities. (Source: https://www.iqvia.com)

- In June 2025, Accenture declared changes to its expansion model and its leadership. Accenture has delivered on its strategy to be its clients’ reinvention partner of choice and to lead in Gen AI via its deeply skilled people and by bringing its clients multi-service solutions, including world-class, AI-permitted assets and platforms, as only Accenture can. (Source: https://newsroom.accenture.com)

- In February 2023, Labcorp declared that the new firm to be formed by the planned spin-off of its Clinical Development business will be known as Fortrea. With over 19,000 people, Fortrea will offer Phase I via IV clinical trial management and commercialization solutions to pharmaceutical and even biotechnology organizations around the world. (Source: https://ir.labcorp.com)

Pharmacovigilance Outsourcing Market Segments Covered in the Report

By Service

- Pre-marketing Pharmacovigilance Services

- Clinical Pharmacovigilance Services

- Case-Processing Services

- Safety Data Management Services

- Medical Review

- Post-marketing Pharmacovigilance Services

- Pharmacovigilance Knowledge Process Outsourcing Services

- IT Solutions and Services

- Others

By Service Providers

- Contract Research Organizations (CROs)

- Business Processing Outsourcing (BPO)

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4449

Frequently Asked Questions:

1) What is Pharmacovigilance Outsourcing?

➢ Contracting external specialists to handle drug-safety tasks (AE/ICSR processing, signal detection, regulatory submissions, aggregate reporting, trial safety).

2) How Big is the Pharmacovigilance Outsourcing Market?

➢ According to Precedence Research, the global pharmacovigilance outsourcing market size is expected to rise from USD 5.29 billion in 2024 to USD 12.12 billion by 2034.

3) What is the Pharmacovigilance Outsourcing Market Growth?

➢ The pharmacovigilance outsourcing market is expected to grow at a notable CAGR of 8.64% between 2025 to 2034.

4) Which are top Companies Operating in Pharmacovigilance Outsourcing Market?

➢ The major companies operating in the pharmacovigilance outsourcing market are Labcorp Drug Development, Icon Plc, Cognizant Technology Solutions Corporation, Ergomed Plc., Capgemini, Genpact Limited, Accenture Plc., Iqvia Holdings Inc. International Business Machines Corporation, Bioclinica Inc., and Others.

5) What are the Driving Factors of Pharmacovigilance Outsourcing Market?

➢ The driving factors of the pharmacovigilance outsourcing market are the rising popularity and ADR reporting and rising number of clinical trials and new drug approvals.

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Pharmacovigilance and Drug Safety Software Market: Discover how advanced software is streamlining adverse event reporting and ensuring drug safety compliance

➡️ Healthcare Contract Research Outsourcing Market: Explore how outsourcing is accelerating clinical trials and reducing costs in global healthcare research

➡️ Contract Research Organization Services Market: Learn how CROs are providing end-to-end solutions for drug development, trials, and regulatory compliance

➡️ Medical Information Market: See how accurate and accessible medical information is enhancing patient outcomes and healthcare decision-making

➡️ Veterinary Pharmacovigilance Market: Understand how monitoring drug safety in animals is shaping the future of veterinary healthcare

➡️ Biomarker Discovery Outsourcing Services Market: Track how outsourcing is expediting biomarker discovery for precision medicine and targeted therapies

➡️ Medical Affairs Outsourcing Market: Explore how outsourcing medical affairs is driving efficiency and compliance across pharma operations

➡️ Drug Discovery Outsourcing Market: Learn how outsourcing drug discovery is accelerating innovation and reducing R&D timelines

➡️ Healthcare BPO Market: See how business process outsourcing is transforming efficiency and patient-centric operations in healthcare

➡️ Regulatory Affairs Outsourcing Market: Discover how outsourcing regulatory services is helping pharma companies navigate global compliance challenges

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.